Out-of-cycle parcel pricing actions drive greater yields, while rates in truckload and LTL stay flat as carriers hang on for freight cycle fundamentals to improve

ATLANTA, Ga. (April 9, 2024) – AFS Logistics, an industry-leading third-party logistics (3PL) provider, and TD Cowen announce the second quarter (Q2) 2024 release of the TD Cowen/AFS Freight Index, a snapshot with predictive pricing for truckload, less-than-truckload (LTL) and parcel transportation markets. The latest release of the index expects LTL and truckload rates to remain steady, consistent with trends established since Q2 of last year. In parcel, the index shows the effect of fuel surcharge increases and other accessorial changes to drive net rate growth in Q1 and Q2 2024, despite limited overall demand.

“While truckload and LTL markets are largely a continuation of established trends, parcel carriers have unleashed a wave of key pricing changes to raise revenue,” says Tom Nightingale, CEO of AFS. “After significant discounting to compete for falling package volumes last year, UPS and FedEx have deployed accessorial charges as more covert tools to increase yields, with changes to fuel, demand and delivery area surcharges targeted to boost revenue.”

Parcel: Discounting cools, off-cycle “GRI-style” pricing changes to boost revenue

As the parcel market continues to face sagging demand, both FedEx and UPS are prioritizing network improvement, cost reduction and targeted revenue generation through pricing changes. Carriers typically communicate updates to fuel and other accessorial charges as part of annual general rate increase (GRI) announcements, but in recent months, carriers have made several out-of-cycle changes. Since the 2024 GRI announcements, UPS and FedEx have increased fuel surcharges three times, boosted demand surcharges and expanded the delivery area surcharge (DAS) to more ZIP codes. With the addition of 82 ZIP codes clustered in urban centers that impact a full 1% of the U.S. population, the total number of ZIP codes subject to the DAS and considered “difficult or costly to access” by the carriers now represents more than half of all ZIP codes in the U.S.

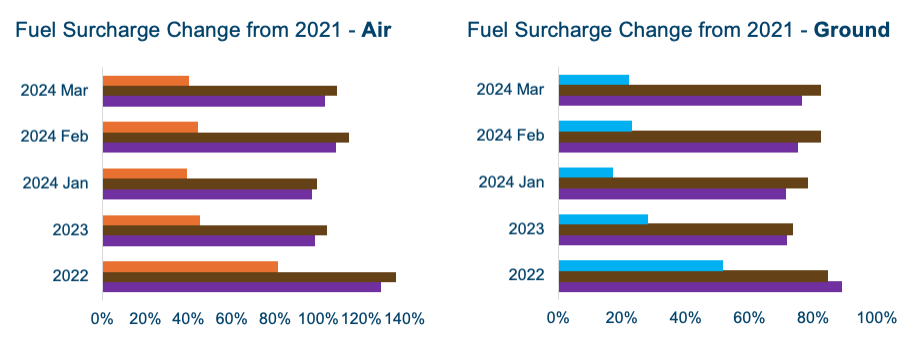

The ground parcel fuel surcharge is based on the U.S. on-highway diesel fuel index, and express is based on the U.S. Gulf Coast kerosene-type jet fuel. As of March 2024, the jet fuel index is up 40% since 2021, but during the same period, the express fuel surcharge is up over 100% for both carriers. A similar discrepancy exists for ground, with the diesel index up 22% since 2021, but the ground fuel surcharge for both carriers is up over 75%.

In express parcel, the effect of the GRI, fuel surcharge adjustments, a shift to more premium services and higher average billed weight more than offset carrier discounting to drive a significant net increase in cost per package in Q1 2024, jumping from 0.9% above the January 2018 baseline in Q4 2023 to 3.9% in Q1 2024. The index projects a slight increase to 4.1% in Q2 2024, in line with the “competitive but rational” parcel market described on the March FedEx earnings call, and an indication of carriers’ desires to move away from the significant discounting they had previously used in the fight for market share.

Ground parcel rate per package also saw a significant jump in Q1 2024, up from 23.8% in Q4 2023 to 28.8% in Q1 2024. Increased fuel surcharge and higher average billed weight fueled growth, and average discount remained flat after significant increases in previous quarters. In Q2 2024, the ground rate per package index is expected to reach 29.3%, nearing the index’s historic high set in Q1 2023 and reversing the trend of three consecutive quarterly year-over-year (YoY) declines.

Truckload: Rates remain low, but stable

In Q1 2024, the truckload rate per mile index fell slightly, from 5.2% above the January 2018 baseline in Q4 2023 to 4.9%. Cost per shipment continued to slide in Q1 2024, down 16.7% YoY and 2.0% quarter-over-quarter (QoQ) – consistent with established trends as a greater share of short haul shipments pushed down average linehaul cost. In the coming months, rate per mile is expected to continue bouncing along the floor established in Q2 2023, with the index projected as 4.8% for Q2 2024 – a slight quarterly decline, but the first YoY increase since Q3 2022.

LTL: Carrier discipline runs up against soft demand

In Q2 2024, the index projects LTL rates will remain at the escalated levels upheld since the Yellow collapse in Q3 of 2023, at 59.4%; above the January 2018 baseline and a 2.4% YoY increase. This expectation represents a modest 0.4% increase from Q1 2024, driven in part by anticipated higher fuel surcharges due to global crude oil production cuts. In Q1 2024, the LTL rate per pound index precisely matched the expectation set out in the last release of the index, declining slightly, from 61.3% above the January 2018 baseline in Q4 2023 to 58.9%. Data indicated downward trends for both weight and distance, with weight per shipment down 4.6% YoY and average length of haul down 7.6% QoQ.

About the TD Cowen/AFS Freight Index

The TD Cowen/AFS Freight Index launched in October 2021, offering a unique perspective on the transportation market through its dataset and forward-looking view. Expected rate levels are derived from visibility to over $39 billion of annual transportation spend across all modes and includes actual net charges that factor in accessorials such as fuel surcharges. Past performance and machine learning produce predictions for the remainder of the quarter, set against a baseline of 2018 rates for each mode.

About AFS Logistics

AFS Logistics helps more than 1,800 companies across more than 35 countries drive sustained savings and operational improvements, while turning their logistics operations into competitive, customer-centric differentiators. As a non-asset based and non-asset biased 3PL, AFS provides a range of logistics services, featuring freight and parcel audit, parcel cost management, LTL cost management and transportation management, which includes freight brokerage and freight forwarding. Founded in 1982 and employing a team of more than 380 logistics teammates in eight major locations across the U.S. and Canada, AFS is regularly part of the Inc. 5000 list of fastest growing companies. To learn more, visit www.afs.net.

###

Media contact:

Dan Gauss

Koroberi

336.409.5391

[email protected]