The era of parcel price increases announced on a predictable, annual cadence with plenty of advance notice for shippers is over. Competition from the United States Postal Service and regional carriers has FedEx and UPS looking to defend their slice of a soft market while trying to shift away from the discount-heavy dynamics of the past year and a half.

USPS has been expanding its parcel business through Ground Advantage, a shipping service that offers delivery within the U.S. in two-to-five business days. This move positions USPS as a stronger competitor against UPS and FedEx, setting the stage for a parcel battle that has the potential to put a dent in the UPS–FedEx duopoly and challenge their dominance in coming years.

So, what can shippers anticipate as they look ahead to the remainder of 2025? More frequent, subtle pricing changes that take effect more quickly, introducing even more complexity to digest and negotiate. And if shippers overlook any one of the many subtle updates carriers make, they can find themselves subject to punitive provisions like a blanket payment processing fee that’s in effect a 2% price hike.

Comparing the players

While each carrier serves distinct niches, they also compete in overlapping areas.

- USPS: As a government agency with a universal service obligation that reaches every U.S. address, USPS has a distinct advantage in terms of coverage. It also has a leg up when it comes to pricing — though that edge could ultimately work against the agency. Government regulations make USPS the most cost-effective choice for lightweight and residential deliveries, but they also restrict its pricing flexibility, contributing to the financial losses it has struggled to contain. The agency is also dealing with an aging infrastructure and their delivery speed is lacking compared to the competition.

- UPS: As a high-volume global logistics powerhouse, UPS is well established as a reliable, fast shipper with an array of strong business solutions. They offer faster, more reliable service than USPS, especially for business-to-business (B2B) shipments, and are superior in terms of tracking and guaranteed delivery. UPS prices are higher, especially for small volume shippers — a problem that is only exacerbated by rising fuel and labor costs — but negotiated rates and multiple service levels often make them a good fit for larger shippers.

- FedEx: The FedEx niche is express and international shipping. FedEx splits its service between the air-based FedEx Express for time-sensitive deliveries and FedEx Ground, a cost-effective option for bulk shipping and packages that don’t absolutely, positively have to be there overnight. Like UPS, FedEx must deal with labor and fuel cost increases, and their small package prices exceed those of USPS, but they remain the leader in express and international shipping.

Given that familiar landscape, how does USPS Ground Advantage stand to gain some yardage on its competition? Let’s talk fees…

The growing impact of the UPS and FedEx fee tug-o-war

In 2024, UPS and FedEx introduced new accessorial fees and adjusted their fuel surcharge indices, increasing costs for shippers. This is nothing new…but, what makes the situation confusing for shippers is the logic (or lack thereof) behind some of the increases and the equally inscrutable aggressive discounting both companies employ to maintain market share.

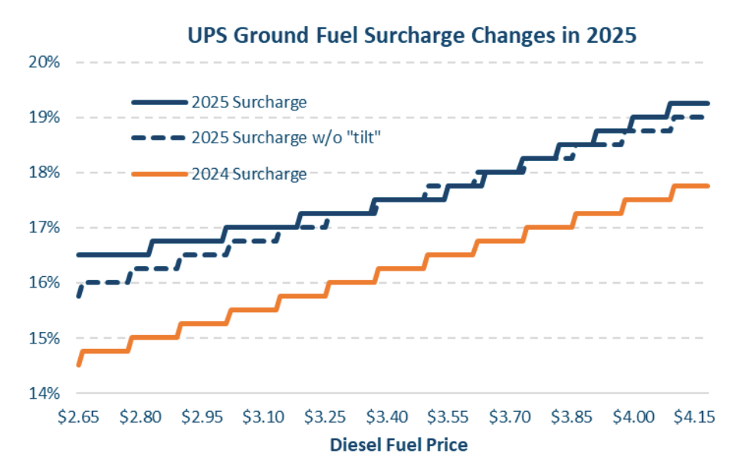

Let’s start with fuel surcharges. In December 2024, UPS introduced its eighth fuel surcharge adjustment for the year — but with a twist. Instead of a uniform increase to the surcharge across fuel price intervals, their adjustment made it so that the fuel surcharge rises faster as diesel prices increase and declines more slowly when fuel prices drop.

But fuel surcharges are just the tip of the iceberg. Both FedEx and UPS established a 5.9% General Rate Increase (GRI) for 2025. Both carriers extended peak season surcharges. Both introduced new rating logic, setting a minimum billable weight of 40 pounds for shipments subject to additional handling surcharges based on dimensions. And both expanded geographies for which rural delivery surcharges are assessed. And the hits just keep on coming. In addition to a wave of payment term changes announced by FedEx and UPS in 2024, UPS has released yet another new batch of changes.

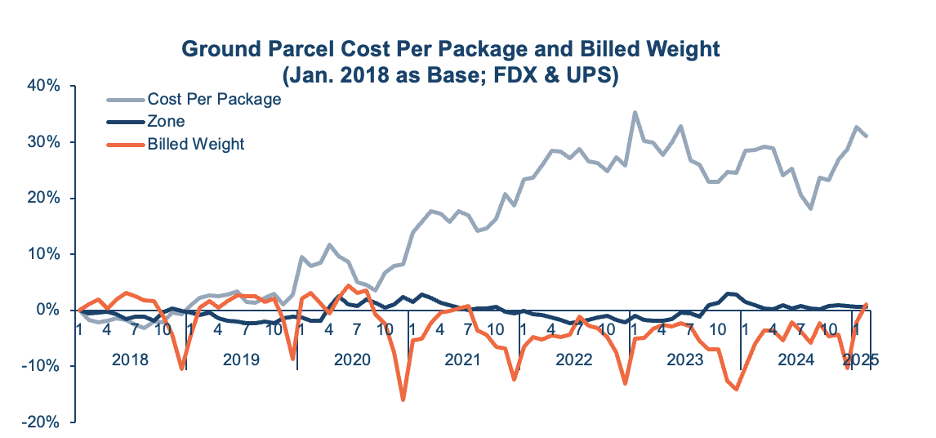

Of course, both UPS and FedEx employ aggressive discounting for large businesses to offset some of these fees but, even so, shippers understandably find it difficult to manage the net effect these persistent, complex increases have on their budgets. According to the TD Cowen/AFS Freight Index, the cost per package for ground parcel is up over 30% compared to 2018 levels. Small and mid-sized businesses (SMBs) without the negotiating power to secure favorable terms may bear more than their fair share of the pain, while e-commerce retailers are struggling with increased fees on residential and oversized shipments.

An alternative approach to parcel shipping

The duopoly of UPS and FedEx remains strong, but ongoing shifts in e-commerce and last-mile delivery are changing the parcel dynamic and challenging their dominance in the coming years. Shippers should play this to their advantage by taking the time to understand and evaluate all the alternatives available to them.

In the face of continued instability and increasing fees, shippers should take proactive steps to diversify their carrier options. That starts with dipping a toe in the water to figure out if alternatives can provide a cost advantage for their business while satisfying the service level their customers require.

USPS Ground Advantage can be one such attractive alternative for shippers dealing with lightweight packages and mostly shipping within zones one and two. Regional carriers offering fast delivery options are a viable alternative to UPS and FedEx for cost-effective last mile delivery, especially in urban areas. Shippers should also consider less-than-truckload (LTL) carriers for larger items to skirt UPS and FedEx oversized shipment fees.

As shippers create a new, diversified playbook for maintaining service levels and controlling costs in an ever-shifting market, consulting with industry experts can help them chart a course and end shipping cost uncertainty. Shipping strategists with expertise and access to extensive transportation spend data can help perform annual benchmarking to optimize costs across all carriers. They also have the experience and buying power to strengthen carrier relationships and help shippers secure better pricing. For carriers and for shippers, winning the shipping game in today’s market depends on adaptability, efficiency and innovation.

This blog also appears on the Argon & Co site.