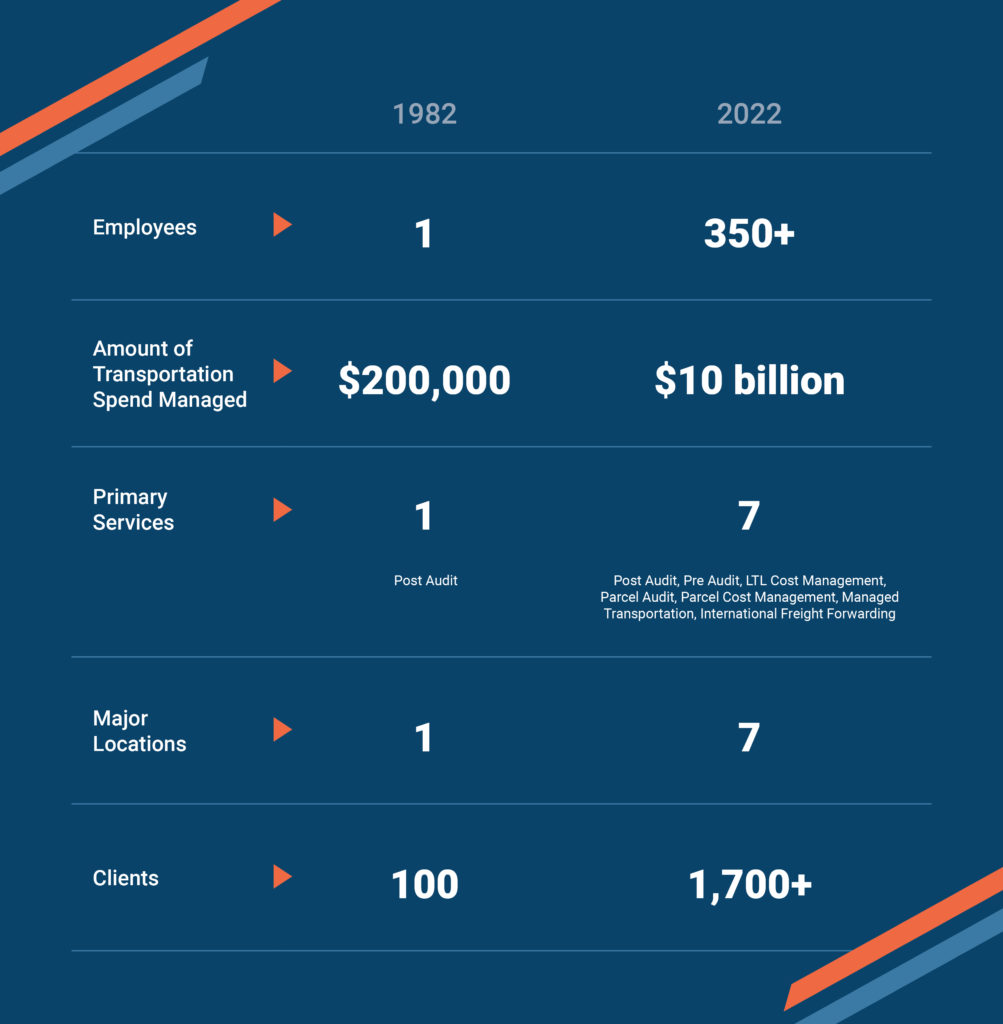

40 may not look good on everyone. But it clearly looks great on AFS – as this head-to-head comparison between our first day and present-day operations shows.

RELATED POSTS

USPS Ground Advantage vs. UPS and FedEx: Who’s winning the parcel game (and is it shippers)?

The era of parcel price increases announced on a predictable, annual cadence with plenty of advance notice for shippers is over. Competition from the United

Déjà vu: More changes to UPS late fees and other payment terms

If parcel carriers changing payment terms and late fees sounds familiar, it should. Just last year, FedEx and UPS unleashed a wave of changes to

Take This Job And Love It: AFS Earns Prestigious Workplace Satisfaction Ranking

We’ve always felt like AFS was an amazing place to be employed. But now we have the hardware to prove it. We’re pleased to announce

Fasten Your Seatbelts For Major Freight Reclassifications

If you like switching things up, you’ll love the latest from the National Motor Freight Traffic Association. On June 12, the organization announced that major

If you do not have a vendor log-in, please fill out the following.

AFS is directing carriers and customers to direct all inbound invoices to [email protected] or via established electronic submission, such as EDI or eSubmit to avoid processing delays due to the impacts of the COVID-19 countermeasures and service interruptions at the United States Postal Service.

Carriers should contact Carrier Support via email at [email protected] in lieu of calls. We have added additional resources and later hours to assist you and email will serve as the method for fastest response. Please send an aging report with your inquiry so that we may provide you the most current status.

Thank you!